Category: downsizing

-

ALL of my nearly 5 years of real-world OGO carshare usage data

Periodically I have openly shared my costs of carsharing with our local OGO Car Share Co-op. This will be the last time, since OGO has joined regional carshare co-op powerhouse Modo. Although I love my OGO, I am really happy that this is happening. Congrats to the whole OGO team here in Okanagan, and I…

-

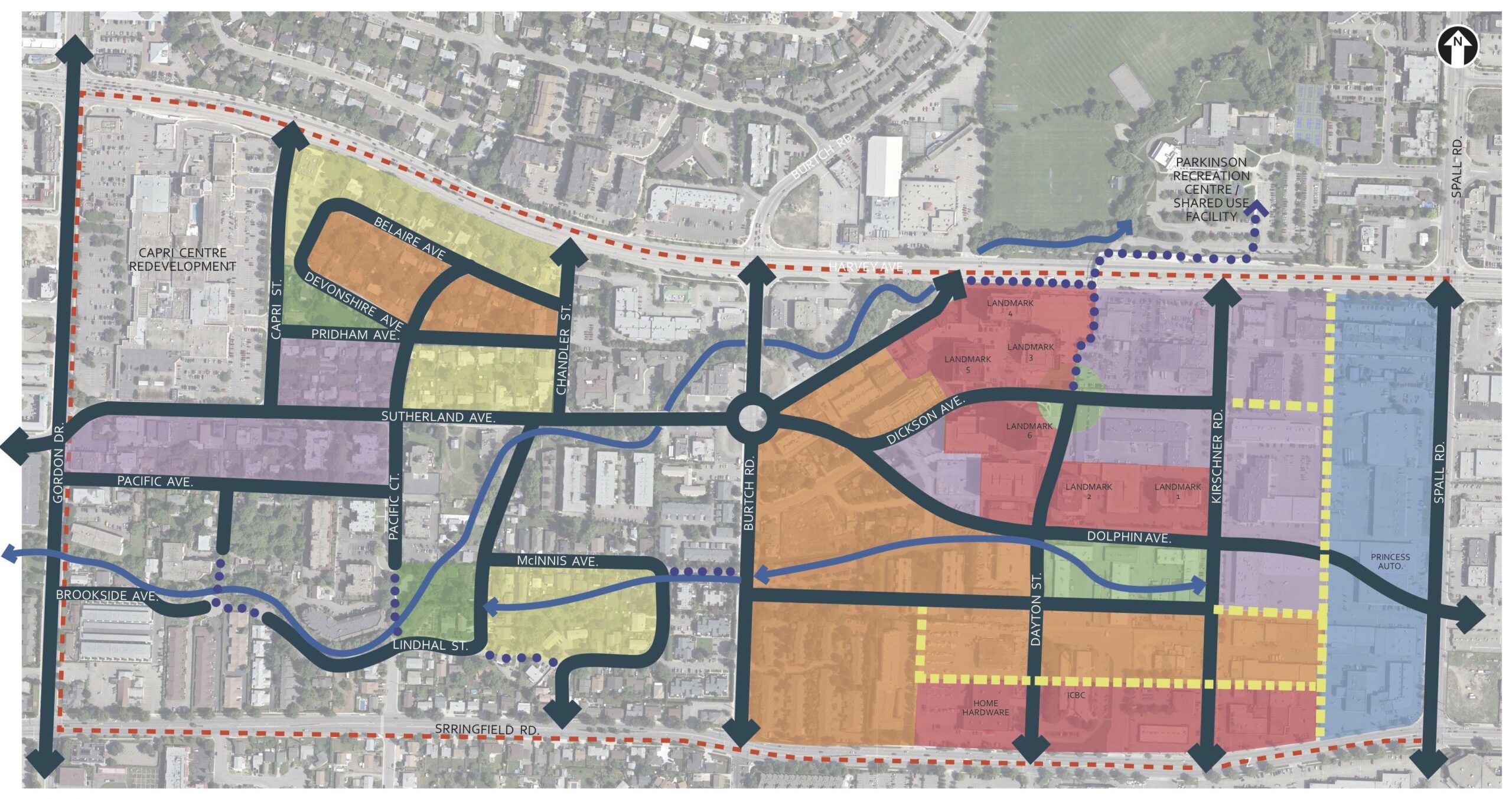

Event: Community planning workshop

The City of Kelowna is holding public consultations in an effort to re-imagine what the Capri-Landmark area will look like in the next few decades. This week I was invited to speak at one of the workshops about my perspective on active transportation. Essentially, I gave the same talk that I did at OnPoint last…

-

On stage at OnPoint: An argument from culture

Me providing (unpaid) plug of OGO Carshare on stage. Photo credit: Deon Nel Photography Urban Systems rounded out their series of workshops on housing, the economy, and climate with their fourth and final workshop on Transportation. The evening focused on thinking about how transportation could enable vibrancy in the community. I shared the panel with…

-

3 years of real-world OGO carshare usage data

It is end of year data time! Here is our 2016 data for OGO Carshare. The average we spend on our vehicle is about $3000 per year, well below the average Canadian who spends $10,456. Keep in mind that this year also included a round-trip to Vancouver (to take my family to the airport) and…

-

C.R.E.A.M.

The War on Cash is an informative piece about the battle against the cashless society. I have been cash-only for a few years, mainly for two reasons: protecting my personal information and financial discipline. In the old days, a transaction would involve two parties: a merchant and a customer. Nowadays, barely a transaction is processed…

-

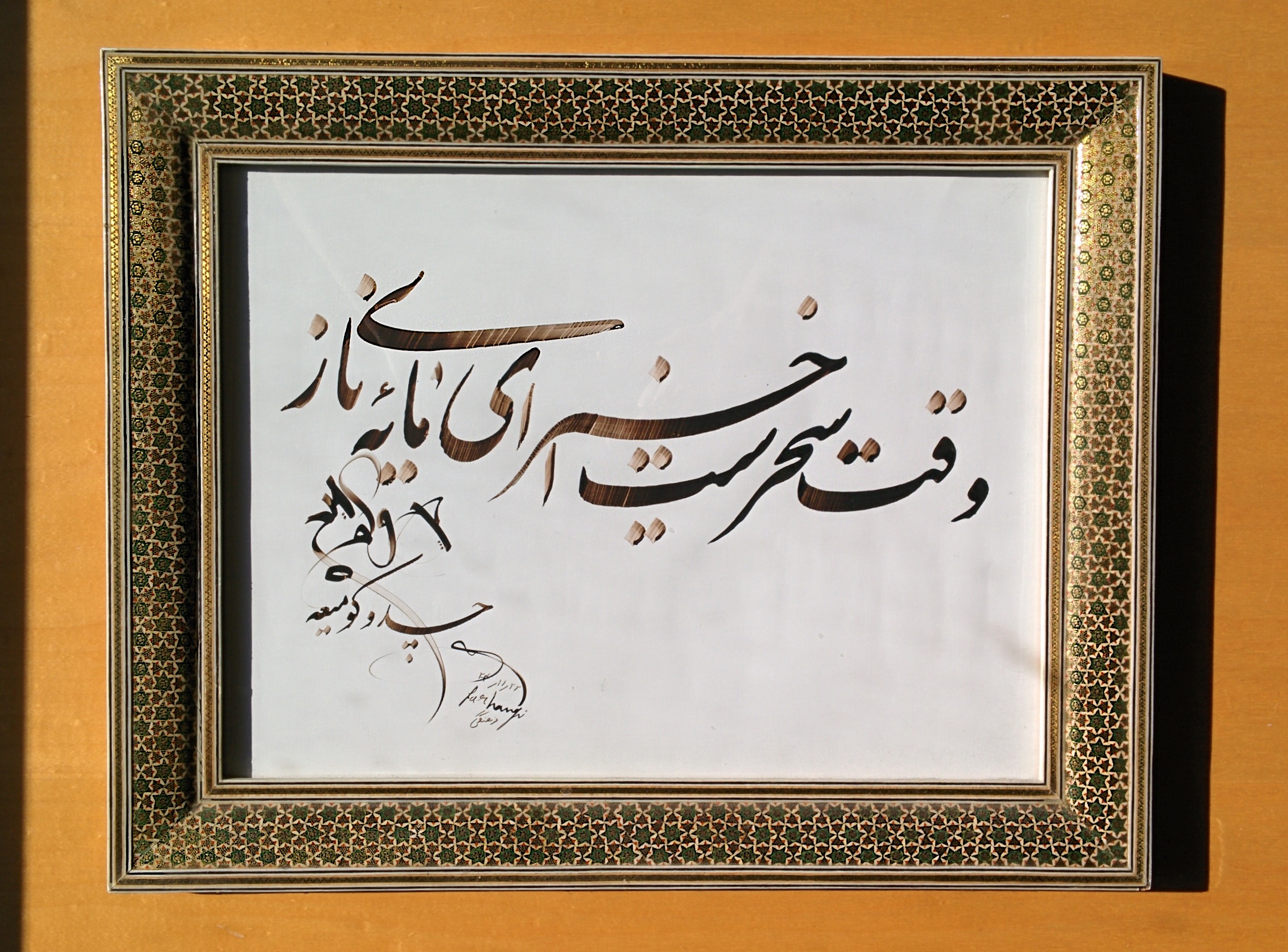

Minimalist wall-hangings

People who think I am a downsizing/minimalist fundamentalist, are surprised when they come into my livingroom and see a number of wall hangings. We don’t have many, but almost all of them are handpainted art (like the family portrait featured in this post). They are all gifts, and have a personal touch. For example, the…

-

Danshari — thinking about “stuff”

When people find out about our efforts at minimalist living, bearing in mind our Japanese background, many ask us about Marie Kondo and her “life-changing magic of tidying up.” The KonMari Method is the latest in decluttering techniques. It seems pretty effective for many people, but we have not read any of her books. We…

-

Questioning “normal consumption” — find out what you actually need!

One of the first things we did when starting our downsizing program was stopped using our credit cards. We had to figure out what our real expenses were each month to get our spending under control, and the cards did not help. In fact, they were a hindrance. Take a look at some stats from…

-

The superficiality of living small

Downsizing (or minimalism) is often portrayed as anti-consumerist and eco-friendly. Living small means you buy less stuff, produce less trash, and have a smaller environmental footprint in terms of heating/cooling your home. Plus, if you position your home close to amenities, you walk/bike more and drive less. Secondly, living small is about removing oneself from…

-

2 years of real-world OGO Carshare usage data

We don’t own a car and we live in an ostensibly small Canadian city (about 150K) and have two small children (6 and 4). Needless to say, we are pretty heavy users of our local OGO Carshare. We use it pretty much every weekend for outings and shopping, and once or twice a month we…